By putting the principles of science math and technology, engineers have been able to make a meaningful impact in various fields and engineers are being…

HR in engineering industry

Human effort engineering is an engineering discipline that primarily deals with the design of human effort and contribution in all areas of occupation. These occupations…

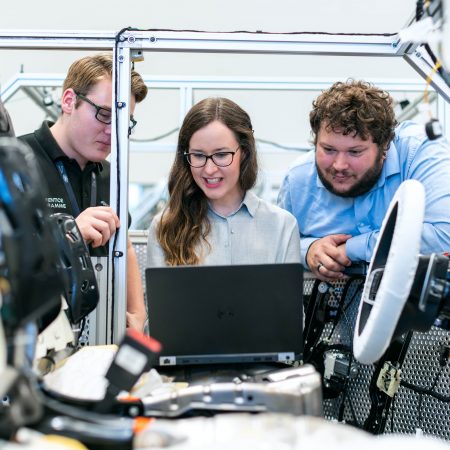

Why engineering is a great career

Engineering is a career that involves not only great thinking, creativity, and self-satisfaction but it’s also a career that comes come with other huge rewards.…

Types of engineering careers to explore

If you are a student with dreams of using scientific principles to change the world, then engineering is the place to be. Here you will…